Journal of Political Science and Public Opinion Volume 3 (2025), Article ID: JPSPO-125

https://doi.org/10.33790/jpspo1100125Research Article

Impact of Industrial Investment on Urban Economic Resilience: Evidence from Third Front Construction in China

Cong Wang1, Bo Chen2, Shiwei Chang3 and Yu Song4*

1School of Economics, Central University of Finance and Economics, Beijing, China.

2Institute of Defense Economics and Management, Central University of Finance and Economics, Beijing, China.

3Planning and Research Institute, Norinco Group, Beijing, China.

4Institutes of Science and Development, Chinese Academy of Sciences, No. 15, North One, Zhongguancun, Haidian District, Beijing, China.

Corresponding Author: Yu Song, Institutes of Science and Development, Chinese Academy of Sciences, No. 15, North One, Zhongguancun, Haidian District, Beijing, China.

Received date: 15th May, 2025

Accepted date: 28th June, 2025

Published date: 30th June, 2025

Citation: Wang, C., Chen, B., Chang, S., & Song, Y., (2025). Impact of Industrial Investment on Urban Economic Resilience: Evidence from Third Front Construction in China. J Poli Sci Publi Opin, 3(1): 125.

Copyright: ©2025, This is an open-access article distributed under the terms of the Creative Commons Attribution License, which permits unrestricted use, distribution, and reproduction in any medium, provided the original author and source are credited

Abstract

In the 1960s and 1970s, China made the strategic decision of “Third Front Construction” (TF) in response to a complex and volatile international situation, proposing to shift the center of gravity of its industry from the east to the central and western regions for national security purposes. This decision not only resolved the national security threats faced by China at that time but also enhanced the industrialization level of the cities in central and western China. This paper constructs a DID model based on the TF as a quasi-natural experiment and uses panel data from 382 counties in Henan, Hubei and Hunan provinces of China from 1993 to 2002 to assess the impact of industrial investment on urban economic resilience in TF. This paper finds that industrial investment in TF significantly enhances the economic resilience of China’s TF areas. Moreover, in the face of the impact brought by the financial crisis, the ability of TF cities to withstand the crisis is stronger than their capacity for economic recovery. The findings provide theoretical support for understanding the economic effects of industrial investment in TF, especially in the context of strategic competition among major global powers and offer a new perspective for China’s future industrial policy.

Key words: Industrial investment, Third Front Construction, urban economic resilience, Difference-in-differences (DID) model.

Introduction

Economic resilience refers to the ability of a system to return to its original state after a shock. This ability includes not only maintaining economic growth during the shock but also resisting the shock and recovering quickly from it [1]. After the global financial crisis, the Sino-US trade war and the Russia-Ukraine war, the international strategic landscape is shifting and the relationships between major powers have entered a phase of competition. Countries or regions with strong economic resilience can respond more effectively to these negative impacts in this context. They are more likely to maintain steady and sustainable economic development [2]. Industry is the core of economic development. Given the current structure of China’s economy and the rising level of industrialization, industrial investment has become a key driver of economic growth. Industrial investment refers to the process in which enterprises and governments use limited financial resources to build businesses and improve infrastructure to boost local economies. In 2020, the fifth plenary session of the 19th Central Committee of the Communist Party of China (henceforth“CPC”) called for building “resilient cities”. This goal was reaffirmed in the report of the 20th National Congress. The need to improve economic resilience is at the heart of building resilient cities. This allows cities to manage uncertainty better and reduce risks during crises or shocks [3]. As a result, building resilient cities has become a significant part of China’s urban development strategy in the new era.

In the 1960s and 1970s, the international situation was complex and volatile. The struggle for world hegemony between the US and the USSR reached its peak. The CPC made a major strategic decision to launch the “Third Front Construction” (henceforth “TF”), with national security as the main priority. The government planned to relocate large factories and skilled workers from the eastern coastal areas to the western region, where the economic base was weaker. This move aimed to strengthen China’s industry and promote balanced economic development to ensure national security. Currently, Sino- US relations have shifted from partnership to competition. Under the backdrop of strategic competition among major powers, Chinese scholars Justin Yifu Lin proposed in 2020 the design of a “New Third Front Construction” (henceforth “NTF”) [4]. The plan includes orderly relocating industries from China’s eastern coastal regions to central and western areas, strengthening infrastructure development and talent cultivation in central and western regions and promoting the flow of scientific and technological innovation resources to these areas. In addition, the Chinese government has implemented a series of measures to promote the NTF. In May 2020, they issued the Guiding Opinions on Promoting the Formation of a New Pattern for the Western Development in the New Era. In January 2022, they introduced the Guiding Opinions on Promoting the Orderly Transfer of Manufacturing Industries. In early 2024, Sichuan Province was named China’s strategic hinterland. At the Third Plenary Session of the 19th Central Committee in 2024, it was once again explicitly stated that the goal is to build a national strategic hinterland and key industrial backup. In September 2024, the Chinese government formally proposed guiding capital, technology and labour-intensive industries to transfer orderly from the eastern regions to the central and western regions. The core objective of the NTF to optimise China’s strategic resource and industrial layout, redirect capital, resources and population towards inland regions, allocate national key projects and achieve regional balanced development goals. The TF was a strategic rear-area construction centred on national industry development, undertaken by China for security purposes. The objectives of the NTF and the TF are both to enhance the security level of China's development, with highly similar construction objectives. Based on this background, this paper focuses on China’s historical TF as the primary research subject, empirically examining how industrial investment affected the urban economic resilience. This paper aims to provide theoretical support for understanding the economic effects of industrial investment under NTF in today’s strategic environment.

Studies have shown that industrial investment in the TF had a positive spillover effect on the local private sector, which remains obvious even after the TF has ended [5]. However, there are few studies on the relationship between industrial investment and urban economic resilience. Therefore, this paper uses the 1997 Asian financial crisis as an external shock to the economic system. It focuses on counties in Henan, Hubei and Hunan provinces in China and constructs a double-difference model to examine how industrial investment in the TF influenced urban economic resilience in these areas. The main contributions of this paper are as follows. Firstly, this paper constructs a difference-in-differences (DID) model using the Beijing-Guangzhou (Jing-Guang) railway as the boundary between the TF and non-TF cities. This serves as a quasi-natural experiment and helps reduce the risk of bias caused by omitted variables. Meanwhile, this paper treats the 1997 Asian financial crisis as a typical external shock and explores how the economic resilience of the TF and non-TF cities responded before and after the crisis. Secondly, this paper adds to the quantitative historical research on the TF. Many earlier studies focused on reviewing the goals, development process and outcomes, or examined specific cities or provinces of the TF in detail. However, few empirical methods have been used based on economic data [6]. Using the DID model and county-level data, this paper measures the impact of industrial investment during the TF on urban economic resilience. This provides a new perspective for understanding this historical policy. Thirdly, the findings of this paper offer valuable evidence for future industrial policy design. The original goal of the TF was to deal with the threat of a possible crisis, so it was not influenced by external economic conditions. Therefore, exploring the link between industrial investment and urban economic resilience in TF can provide valuable experience for the precise implementation of industrial investment in China and the enhancement of urban economic resilience.

Literature review

Resilience refers to the ability of a system to maintain stability and recover quickly after experiencing external shocks [7-8]. The concept of resilience has gone through three main stages: ecological resilience [9], engineering resilience [10] and evolutionary (adaptive) resilience [11]. The term was first introduced into spatial economics by the scholar Reggiani [12]. Since then, research on economic resilience has gradually expanded. This concept is used to describe how different economic agents respond to business cycles or external shocks. It reflects both their ability to resist shocks and their capacity to recover and regenerate [1]. At the regional level, economic resilience captures how well a spatial economic system can deal with external shocks [13]. It can be measured across different geographic scales and provides insight into the strength and adaptability of local or regional economies. At this stage, Martin proposed that regional economic resilience is the key to maintaining long-term, stable economic development in a region. This view has been widely accepted by scholars [1]. Regional economic resilience reflects the dynamic process of how a system responds to change. It is usually analyzed through four dimensions: vulnerability, resistance, robustness and resilience [14,15]. These dimensions not only focus on a region’s ability to prevent and withstand risks but also emphasize its ability to reorganize and explore new development paths. Together, they provide a more complete understanding of the meaning of regional economic resilience.

In the past two decades, regional economic systems have often faced external uncertainty. One major example was the 2008 global financial crisis, which had a negative impact on regional economic development. As a result, regional economic resilience has become a key topic in academic research. It is used to describe the region’s ability to absorb shocks, maintain growth and recover after disruptions [16,18]. Recent studies have shown that several factors influence regional economic resilience, including policy and institutional environments, digital development and industrial structure [2]. Among these, industrial structure is an important factor affecting regional economic resilience. It mainly works through two aspects: diversification and specialization [19]. Regions often adjust their industrial structure by implementing targeted policies. This is especially important for economically underdeveloped or poor regions, which rely on government support such as financial subsidies, talent introduction and technical assistance to drive structural transformation and unlock economic potential [20]. During this process, increased business activity leads to more job opportunities, thus positively affecting the wage level and employment quality in the region [21-23]. In the long run, the quality of the labor force plays a key role in determining the path of economic development [24]. As the industrial structure upgrades, workers shift across different sectors and their overall quality or skill levels are expected to improve [25]. In addition, investment in research and development and education can improve innovation capacity and talent quality. This helps speed up both diversification and specialization in the industrial structure [26,27] and enhances a city’s ability to manage uncertainty. In general, the current focus on high-quality development in China can be reflected in how well the economic structure is optimized [28]. Many regions promote industrial upgrading by using financial subsidies, technical support and talent attraction to unlock growth potential and improve their ability to cope with uncertainty [29-31]. These efforts directly support the improvement of regional economic resilience.

Industrial investment is a key driver of economic growth transformation [32,33]. It can improve the efficiency of industrial production in a region. It may have a solidifying effect in the short term, allowing industrial structure adjustment to support economic growth for a certain period [34,35]. This effect mainly works through two micro-level mechanisms: value creation and R&D investment. These mechanisms in turn promote structural changes in the industry. Industrial investment not only helps firms overcome short-term challenges such as funding shortages and barriers to innovation but also encourages more business investment. This boost in investment can increase enterprise value and support long-term business development [36]. Recent studies based on firm-level data from the US, Germany and Europe have reached a consistent conclusion through empirical analysis [37-40]. Industrial investment channels funds into enterprise innovation and talent development, which helps cities attract high-quality professionals and advance technological progress. This in turn enhances the vitality of enterprises and strengthens a city’s ability to withstand risks [41]. Moreover, innovation and technological progress improve the efficiency and rationality of industrial resource allocation. These improvements support upgrading the industrial structure, which further enhances a city’s ability to manage risks and recover from external shocks [42,44].

Does industrial investment positively impact the economy and improve a city’s economic resilience? Firstly, industrial investment enhances the urban economic resilience by directly creating jobs and indirectly stimulating employment in related industries. Research shows that large-scale industrial projects not only absorb manufacturing labour but also drive the coordinated development of upstream and downstream industrial chains, forming a diversified employment structure [45]. Secondly, industrial investment has significant positive externalities for infrastructure improvement. On the one hand, industrial investment typically drives upgrades in transportation, energy and communication infrastructure. For example, research on China’s Yangtze River Economic Belt shows that rationalising industrial structure through optimised resource allocation enhances infrastructure development, thereby strengthening a city’s ability to recover from natural disasters and emergencies [46]. On the other hand, the intelligent and green transformation driven by industrial investment, combined with hardware upgrades and software optimisation, enables cities to quickly restore production order in the face of external shocks [47]. Thirdly, the long-term effects of industrial investment are reflected in driving technological innovation and restructuring the industrial ecosystem. Strategic industrial investment typically guides the aggregation of production factors toward high-value- added sectors. This upgrading not only enhances the risk-resilience of the industrial chain but also fosters emerging industries through technology spillover effects [48,49]. Existing literature has revealed the pathways through which industrial investment influences urban economic resilience from three dimensions: employment stability, infrastructure optimisation and long-term economic development. Against the backdrop of intensifying global competition and geopolitical risks, the decentralised layout experience of the TF provides valuable insights for China’s NTF. Therefore, this paper enriches the research on economic resilience from the perspective of industrial investment in the TF. The central question is whether increased regional industrial investment by the state can create more business opportunities, address employment challenges and ultimately strengthen the economic resilience of the entire region.

Policy Background

In the 1960s and 1970s, China launched the TF (1964-1980). It involved relocating numerous factories, enterprises, workers and officials from eastern coastal areas to the interior. A significant amount of financial resources from the government was also directed to the TF areas, which significantly impacted various aspects of China’s industry, science, technology, economy and society [50]. The TF covered a vast area, including regions east of the Wushaoling Mountain in Gansu, south of Yanmen Pass in Shanxi, west of the Jing Guang railway and north of Shaoguan in Guangdong. It encompassed all or most of the seven provinces and autonomous regions: Sichuan, Guizhou, Yunnan, Shaanxi, Gansu, Qinghai and Ningxia, as well as parts of the western areas of Henan, Hubei, Hunan and Shanxi. In total, this area spanned 3.18 million square kilometers, which is about one-third of China’s land area.

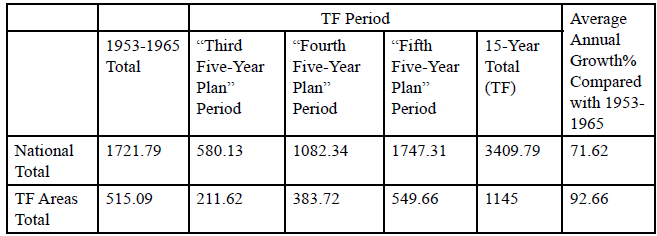

During the TF period, industrial fixed assets in the area increased from 29.2 billion yuan to 154.3 billion yuan, marking a 4.28-fold growth, accounting for about one-third of China’s total at that time. The number of employees increased from 3.2565 million to 11.295 million, growing by 2.46 times. The total industrial output value grew from 25.8 billion yuan to 127 billion yuan, an increase of 3.92 times [51]. In the high-tech industry, a strong production base and many advanced scientific research and testing facilities were built. Several important railways, highways, main lines and branch lines were constructed in the transportation sector. Since 1965, ten main railways have been completed one after another, including Chuan Qian, Gui-Kun and Cheng-Kun. In addition to these main lines, branch and special lines were also built, adding a total of 8,046 kilometers of new railways. Road construction also advanced rapidly, with the total length of new roads reaching 227.8 thousand kilometers during this period. In the industrial infrastructure, numerous enterprises and industrial bases in sectors such as machinery, energy and raw materials were established. Between 1965 and 1975, 124 large and medium-sized machinery industry projects were built as part of the TF. In addition, the TF promoted China's economic prosperity and scientific and technological progress, creating development opportunities for the mainland’s future construction. For example, Panzhihua, Liupanshui, Shiyan and Jinchang, once sparsely populated mountainous areas, have become well-known industrial cities. After deciding to launch the TF plan, the state concentrated human, material and financial resources to implement it. The plan was integrated with China’s Third Five-Year Plan, which promoted the economic development of the TF areas. From 1953 to 1965, the TF areas added 51.509 billion yuan in new fixed assets for capital construction, accounting for 29.92% of the national total. Following the Third, Fourth and Fifth Five-Year Plans, this proportion reached 33.58% from 1965 to 1980. Although the proportion of new fixed assets during the Fifth Five-Year Plan period declined, it still amounted to 54.966 billion yuan. Comparison of new fixed assets for capital construction in the TF areas and nationally during the Third, Fourth and Fifth Five-Year Plans is shown in Table 1.

The Jing-Guang railway starts from Fengtai Station in Beijing in the north and ends at Guangzhou Station in the south, crossing Hebei, Henan, Hubei and Hunan provinces. Based on the above description, the cities located west of the Jing-Guang railway in Henan, Hubei and Hunan provinces are considered the TF cities, while those east of the railway are categorized as non-TF cities. After the completion of the TF, China has experienced two significant economic slowdowns: the Asian financial crisis in 1997 and the global financial crisis in 2008. The 1997 Asian financial crisis was a targeted attack on Asian countries and financial systems by international lobbyists, who exploited the open market environment and the imperfections in the financial markets of these countries. Therefore, this paper considers the 1997 Asian financial crisis as an exogenous shock to China’s economic system. The Jing-Guang railway is used to distinguish between TF cities and non-TF cities. Based on this distinction, a DID model is constructed to examine the impact of industrial investment on urban economic resilience.

Empirical Strategies

Methodology

This paper constructed a DID model to examine the impact of industrial investment from the TF on economic resilience. The DID model typically involves defining two dummy variables and estimating the relationship between their interaction term and the dependent variable. Here, the TF is treated as a quasi-natural experiment. The DID model is used to evaluate how the TF cities performed in terms of economic resilience during the 1997 Asian financial crisis. To apply this model, the sample data is divided into two groups: an experimental group and a control group, as well as two time periods—before and after the crisis. The experimental group includes cities located west of the Jing-Guang railway (including those located directly on the line), which are considered the TF cities. The control group includes cities located east of the railway, which are non- TF areas. The model is set as follows: RESrt = β0 + β1du + β2dt + β3 (dt × dt) + θXrt + εrt (1)

where RESrt represents urban economic resilience; du is a policy dummy variable, where du = 1 represents an experimental group and du = 0 represents a control group; dt is a dummy variable for time, dt = 0 represents the experimental period which refers to the pre crisis period (1993 to 1997), dt = 1 represents the experimental period which refers to the post-crisis period (1998 to 2002); Xrt represents control variables.

Data

Urban economic resilience (RES). The measurement of this variable follows the counterfactual approach used by Martin [52], which reflects the city’s ability to deal with external shocks by selecting one or more key indicators. Common choices include the employment rate, GDP growth rate or a set of combined indicators. This paper uses the GDP growth rate to measure economic resilience. However, there is a limitation that China did not record county-level GDP before 1997; the lack of data affects the empirical analysis. Studies have shown that city lighting data is closely linked to economic activity. Unlike official GDP figures, lighting data is not limited by administrative boundaries. This helps avoid the risk of inflated GDP numbers reported by local officials. Lighting brightness offers a more objective and reliable measure of regional economic development [53]. Therefore, this paper uses city-level lighting data instead of GDP to measure economic resilience. The current global lighting data includes DMSP/OLS and NPP/VIIRS data, collected by different satellites. DMSP/OLS covers 1992 to 2013, while NPP/ VIIRS starts from 2012 onward. We use DMSP/OLS data in this paper.

Urban economic resilience is usually based on national economic performance over a certain period. It is calculated by using the actual change in the GDP of a city against the expected change to obtain the difference in the economic performance of different cities in that period, showing the ability of the city to withstand or recover from shocks. The equation is as follows:

where(Et+Tr)excepted denotes the expected change in light brightness for city r in year t+T; gt+T N represents the national growth rate of light brightness in year t+T; Et rdenotes the light brightness for city r in the base year t; RESrt is the economic resilience for city r from year t to t+T; and ∆Er stands for the actual change in light brightness for city r in year t+T. The value measured by equation (2) usually fluctuates around 0. If it is greater than 0, it indicates that the urban economic resilience of city r is higher than the statistical average. The larger the value represents the better the economic resilience of the city. If the value is less than 0, it represents the poorer ability of city r to withstand the crisis or the more difficult to adjust to recovery after the shock.

Industrial investment (Trepost). This variable is the interaction term between the individual city dummy variable and the time dummy variable for the 1997 financial crisis. Specifically, in this paper, the variable Treat is set to 1 for cities located west of the Jing-Guang railway (the TF cities) and 0 for cities located east of the railway. The time dummy variable Post is set to 0 for the period before the crisis and 1 for the period after the crisis. Therefore, the value of Trepost is 1 represents after the crisis for a TF city r; while for all others, it is 0.

The control variables include the following. Firstly, the economic conditions of each county before the TF, this paper considers the urbanisation rate and population density in 1964 to control the initial economic development conditions of each county, and the data are calculated based on the Second National Population Census of the People’s Republic of China. Secondly, transportation variables include highway density, railway density and river density in 1962 for each county. The data about road and railway density is sourced from Baum (2017) [54]. River density is calculated using GIS with the elevation data from SRTMDEM. Thirdly, geographic factors are also considered. This paper includes variables such as average elevation, average slope, terrain undulation and distance to the provincial capital for each county. These factors help control the geographic impact on the location of industrial investment in the TF, as well as on economic development. The raw data for elevation, slope and terrain undulation are calculated in GIS using the SRTMDEM elevation data.

The 1997 Asian financial crisis affected countries such as Malaysia, Singapore, Japan, South Korea and China. This paper uses panel data from 382 counties in Henan, Hubei and Hunan Provinces of China from 1993 to 2002 to study the impact of industrial investment on urban economic resilience and the mechanisms through which industrial investment plays a role.

Further Discussion

As a result of the Asian financial crisis, the national economy experienced a slowdown in economic growth in 1997, reaching its lowest point in 1999. Since then, the economy has followed an upward trend. When clustering the resilience of the TF cities, using light brightness as the core indicator at the city level, it is observed that these cities experienced a significant decline in economic resilience in 1997, which starkly contrasted with the positive economic trends of the previous year. After this brief shock, the economic resilience recovered rapidly. This paper further examines the relationship between industrial investment and economic resilience. The model is presented in equation (4): RESrt = β0+ β1TFrt + θXrt + εrt (4)

where RESrt is used to calculate the economic resilience of the TF cities, during and after the financial crisis, using 1997 to 1999 and 2000 to 2002 as periods, respectively.

The explanatory variable TFrt represents the investment intensity of the TF for city r in year t. This paper follows the approach of Fan & Zou [5], which uses the ratio of the number of employees in large and medium-sized industrial enterprises to the local population of counties in the TF areas in 1985 as a proxy variable for the amount of investment in the TF. There are three main reasons for choosing this variable. Firstly, a large amount of investment in industrial enterprise construction during the TF, industrial enterprise data can reflect the scale of investment in the TF. Secondly, the data in 1985 can accu rately reflect the investment and construction during the TF, making it a strong proxy variable for the amount of investment in the TF. The TF not only relocated some enterprises from the first and second front areas to the TF areas but also built and expanded several new enterprises in the TF areas. The data in 1985 on industrial enterprises is cumulative, including information about relocated, newly estab lished and expanded enterprises. Additionally, although the TF was largely completed by 1980, some newly built or unfinished factories were implemented in the following years. Therefore, the 1985 data also captures the information about these enterprises that were fi nalized after the initial phase of the TF. Thirdly, using the employee ratio indicator helps avoid the influence of price factors from the planned economy. The data on employees of large and medium-sized industrial enterprises comes from the 1985 Industrial Census of the People’s Republic of China (Volume II, Directory of Large and Me dium-sized Industrial Enterprises). The population data for counties is sourced from the Third National Population Census.

Xrt denotes control variables, including both economic and geo graphic factors. For the long-term period estimation, the administra tive boundaries of counties are adjusted and the variables for each year are matched to 2000 GIS maps to harmonize the administrative boundaries.

Empirical results

Benchmark regression results and analysis

Parallel trend test

The DID model begins with a parallel trend test, which requires that the experimental and control groups have the same development trend before the policy is implemented. However, after the policy is introduced, the two groups should show different behaviors. In this paper, we follow the approach of Jacobson et al. [55] to conduct the parallel trend test for equation (1) and the model is presented in equation (5): Dnvaluert = β0+ ∑2002t=1993βtTrepostrt+θXrt+εrt (5)

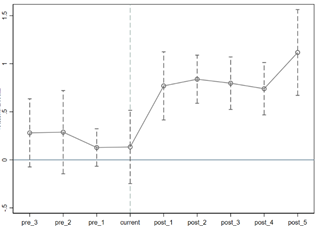

From the test results in Figure 1, the estimated coefficients fluctuate around 0 before the outbreak of the financial crisis, while the coeffi cients in the year of the financial crisis and beyond are significantly positive. This indicates that there was no significant difference in the trend of economic resilience change between the TF cities and non - TF cities in the experimental and control groups before the outbreak of the financial crisis. Therefore, the assumption of a parallel trend is satisfied. Further, the value has increased significantly after the f inancial crisis, with the economic resilience of the TF cities showing a notable and positive increase. This supports the theoretical analysis in the previous section and indicates that the use of the DID model is reasonable.

Regression results and analysis

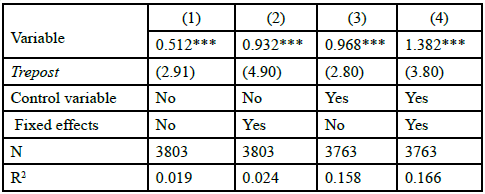

Table 3 presents the benchmark regression results of equation (1) for examining the impact of industrial investment on urban economic resilience. In Table 3, Column (1) and Column (2) display the regression results without control variables. Column (1) shows the results without fixed effects, while Column (2) presents the results with fixed effects. Columns (3) and (4) show the regression results after adding control variables to Columns (1) and (2), respectively. Based on the reported results, we observe that all coefficients are significantly positive at the 1% level. This indicates that the TF has a significant positive impact on improving urban economic resilience.

Further discussion

Regression results and analysis

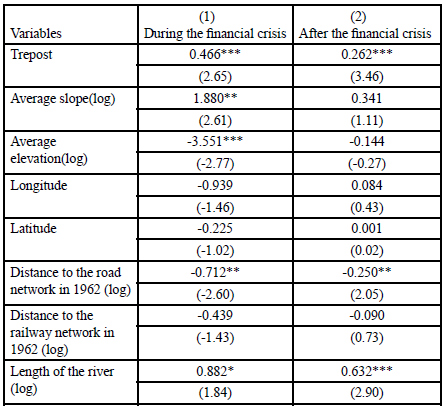

Table 4 presents the regression results for equation (4). Columns (1) and (2) show the impact of the TF on economic resilience during the financial crisis (1997-1999) and after the financial crisis (2000-2002), respectively. The estimated coefficients reveal that investment in the TF had a significant positive impact on economic resilience both during and after the financial crisis. However, the effect becomes about 50% smaller after the financial crisis, though it remains statistically significant. According to the estimated results of the financial crisis, except for the positive coefficient of average slope, the estimated coefficients for average elevation, distance to the road network and population density are all negative. This suggests that the TF project strictly adhered to the construction policy of “leaning against the mountain, dispersed and hidden”. The results in Table 4 indicate that during the financial crisis, investment in the TF helped cities better withstand the destructive effects of the crisis and facilitated economic recovery. However, the ability to withstand the crisis is stronger than the ability to recover.

Robustness test

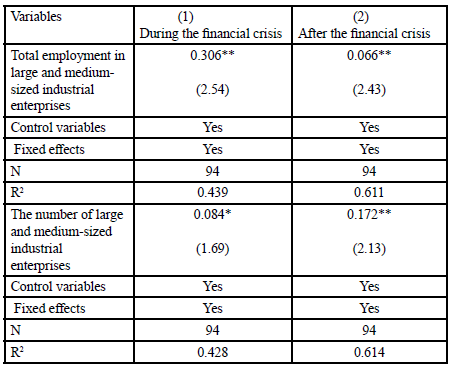

This paper re-measures the investment intensity in the TF for robustness testing, using two variables to reassess. The first variable directly uses total employment in large and medium-sized industrial enterprises. Since the primary goal of the TF was national security rather than economic development, the establishment of medium and large-sized enterprises did not directly depend on the local economic environment. Therefore, the total number of employees can also measure the scale of investment in the TF. The second variable uses the number of large and medium-sized industrial enterprises in each county and district within the TF areas. The validity of this indicator is supported in two ways. Firstly, by its cross-sectional dimension. During the Third Five-Year Plan, major industrial projects were established in the TF areas, which aligns well with the database used.

Additionally, relocated TF firms were typically larger and more likely to be included in the medium- and large-sized enterprise database. Secondly, the time dimension. The industrial census in 1985 was the first nationwide survey conducted after the completion of the TF. Although the main period of the TF was from 1964 to 1980, the number of regional large and medium-sized state-owned enterprises changed relatively little before the official launch of market-oriented reforms in 1992. As a result, this indicator remains a reliable measure of the investment situation during the TF. The results of the robustness test are shown in Table 5. From the estimated coefficients, the coefficients of total employment in large and medium-sized enterprises, as well as the number of large and medium-sized industrial enterprises, re-measured as the investment intensity of the TF, are all significant. This indicates that the regression results are robust.

Conclusion

Improving economic resilience is the most effective support for risk prevention, especially in the face of profound exogenous negative shocks. The implementation of the TF not only rectified the weaknesses in basic industries, transportation and resource development in Mainland China but also fostered the economic development of regional economies. This paper treats the TF as a “quasi-natural experiment” and uses the 1997 Asian financial crisis as an exogenous shock. It measures the economic resilience of each city within a counterfactual framework and constructs a DID model, utilizing the Jing-Guang railway as a distinguishing factor. The paper systematically evaluates the impact of industrial investment on economic resilience in the TF significantly enhances urban economic resilience. Further analysis reveals that compared to post-crisis economic resilience, industrial investment in the TF is more effective in helping cities withstand the devastation caused by the financial crisis.

The study of economic resilience based on the current sample region shows that the heavy industrial clusters and regional industrial chain layout formed through centralised industrial investment during the TF significantly enhanced the urban economic resilience of the TF areas. At present, the global industrial chain faces the risk of decoupling and breaking the chain, so China needs to learn from the experience of the TF and embed national security into the logic of industrial investment. Quantitative research based on historical events offers a fresh perspective for shaping future industrial policies. The study of economic resilience in the sample region shows that the heavy industrial clusters and regional industrial chain layouts formed through centralized industrial investment during the TF significantly enhanced the urban economic resilience of the TF areas. Given the current global risks of industrial decoupling and supply chain disruptions, China can learn from the experience of the TF and integrate national security considerations into the logic of industrial investment. Firstly, the focus should be on supporting the localization of strategic industries such as semiconductors and new energy, while strengthening industrial clusters led by key enterprises. Secondly, regional industrial synergies can be achieved through new infrastructure investment, avoiding excessive concentration on the eastern seaboard. Thirdly, while the closed nature of the TF led to technological path dependence, the new era requires a high level of openness to enhance resilience. China must integrate the lessons of the TF with a new national development system. By blending historical experience with contemporary innovation, the TF from the past century offers China a roadmap for restructuring the global industrial chain. The concept of NTF could become a core strategy for addressing strategic competition among major powers and constructing a new development pattern.

Competing Interest:

The authors declare that they have no competing interests.

References

Martin, R. & Sunley, P. (2010). The place of path dependence in an evolutionary perspective on the economic landscape. Handbook of Evolutionary Economic Geography, 62-92. View

Yuheng, L., Cheng, W., Xiao, W. (2024). Measuring national economic resilience to the SARS and COVID-19 pandemics. Applied Economics, 56(51): 6467-6482. View

Jiang, N., Jiang, W., Wang, Y., Zhang, J. (2024). Impact of financial reform on urban resilience: Evidence from the financial reform pilot zones in China. Socio-Economic Planning Sciences, 94: 101962. View

Lin, Y.F. & Fu, C.H. (2020). Leverage comparative advantages through adaptive governance and repurpose strategic industrial capabilities for local comparative advantages. Chengdu Daily. (in Chinese).

Fan, J. T. & Zou, B. (2021). Industrialization from Scratch: The “Construction of Third Front” and Local Economic Development in China’s Hinterland. Journal of Development Economics, 152: 1-22. View

Naughton, B. (1988). The Third Front: Defense Industrialization in the Chinese Interior. The China Quarterly, 115:351-386. View

Rose, A. & Lim, D. (2002). Business interruption losses from natural hazards: Conceptual and methodological issues in the case of the Northridge earthquake. Global Environmental Change Part B: Environmental Hazards, 4(1): 1-14. View

Martin, R. (2011). Regional economic resilience, hysteresis and recessionary shocks. Journal of Economic Geography, 12(1): 1-32. View

Holling, C. S. (1973). Resilience and stability of ecological systems. Annual Review of Ecology and Systematics, 1(4): 1-23. View

Pimm, S. (1984). The complexity and stability of ecosystems. Nature, 307: 321-326. View

Ramlogan, R. & Metcalfe, J. S. (2006). Restless capitalism: A complexity perspective on modern capitalist economies. Complexity and Co-evolution: Continuity and Change in Socio economic Systems, 1: 115-146. View

Reggiani, A., De Graaff, T., Nijkamp, P. (2002). Resilience: an evolutionary approach to spatial economic systems. Networks and Spatial Economics, 2: 211-229. View

Modica, M. & Reggiani, A. (2015). Spatial economic resilience: Overview and perspectives. Networks and Spatial Economics, 15(2): 211-233. View

Martin, R. (2015). Roepke lecture in economic geography rethinking regional path dependence: Beyond Lock-In to evolution. Economic Geography, 86(1): 1-27. View

Martin, R. & Sunley, P. (2020). Regional economic resilience: Evolution and evaluation. In Handbook on Regional Economic Resilience. Edward Elgar Publishing, 10-35. View

Wang, Z., & Wei, W. (2021). Regional economic resilience in China: Measurement and determinants. Regional studies, 55(7): 1228-1239. View

Gu, J., & Liu, Z. (2024). A study of the coupling between the digital economy and regional economic resilience: Evidence from China. Plos One, 19(1): e0296890. View

Duan, W., Madasi, J. D., Khurshid, A., Ma, D. (2022). Industrial structure conditions economic resilience. Technological Forecasting and Social Change, 183: 121944. View

He, D., Miao, P., Qureshi, N. A. (2022). Can industrial diversification help strengthen regional economic resilience?. Frontiers in Environmental Science, 10: 987396. View

Chen, J. (2021). The influence of fiscal and financial policies on upgrading of regional industrial structure. Open Access Library Journal, 8(11): 1-17. View

Busso, M., Gregory, J., Kline, P. M. (2013). Assessing the Incidence and Efficiency of a Prominent Place Based Policy. The American Economic Review, 103: 897-947. View

Givord, P., Rathelot, R., Sillard, P. (2013). Place-based Tax Exemptions and Displacement Effects: An Evaluation of the Zones Franches Urbaines Program. Regional Science and Urban Economics, 43(1): 151-163. View

Mayer, T., Mayneris, F., Py, L. (2017). The Impact of Urban Enterprise Zones on Establishments’ Location Decisions: Evidence from French ZFUs. Journal of Economic Geography, 17(4): 709-752. View

Pomi, S. S., Sarkar, S. M., Dhar, B. K. (2021). Human or physical capital, which influences sustainable economic growth most? A study on Bangladesh. Canadian Journal of Business and Information Studies, 3(5): 101-108. View

Zhibiao, L., & Yonghui, L. (2022). Structural transformation, TFP and high-quality development. China Economist, 17(1): 70-82. View

Glaeser, E.(2011). Triumph of the City: How Our Greatest Invention Makes US Richer, Smarter, Greener, Healthier, and Happier. New York: Penguin Press. View

Huggins, R. & Thompson, P. (2015). Local entrepreneurial resilience and culture: The role of social values in fostering economic recovery. Cambridge Journal of Regions, Economy and Society, 8(2): 313-330. View

Chen, L. & Huo, C. (2022). The measurement and influencing factors of high-quality economic development in China. Sustainability, 14(15): 92-103. View

Zhang, L., Lin, G., Lyu, X., Su, W. (2024). Suppression or promotion: research on the impact of industrial structure upgrading on urban economic resilience. Humanities and Social Sciences Communications, 11(1): 1-14. View

Xu, S., Zhong, M., Wang, Y. (2024). Can innovative industrial clusters enhance urban economic resilience? A quasi-natural experiment based on an innovative pilot policy. Energy Economics, 134: 107544. View

Ye, Z., Li, J., Chen, J. (2025). The promotion mechanism of financial agglomeration and human capital on urban economic resilience: Based on the moderating effect of industrial structure. International Review of Economics and Finance, 97: 103764. View

Appiah, M., Gyamfi, B. A., Adebayo, T. S., Bekun, F. V. (2023). Do financial development, foreign direct investment, and economic growth enhance industrial development? Fresh evidence from Sub-Saharan African countries. Portuguese Economic Journal, 22(2): 203-227. View

Koval, V., Hrymalyk, A., Kulish, A., Kontseva, V., Boiko, N., Nesenenko, P. (2021). Economic policy of industrial development and investment approach to the analysis of the national economy. Studies of Applied Economics, 39(6): 1-15. View

Neffke, F., Hartog, M., Boschma, R., Henning, M. (2018). Agents of structural change: The role of firms and entrepreneurs in regional diversification. Economic Geography, 94(1): 23-48. View

Andreoni, A., & Chang, H. J. (2019). The political economy of industrial policy: Structural interdependencies, policy alignment and conflict management. Structural Change and Economic Dynamics, 48(2): 136-150. View

Dai, Y., Hou, J., Li, X. (2021). Industry policy, cross-region investment, and enterprise investment efficiency. Research in International Business and Finance, 56: 101372. View

Cainelli, G., Ganau, R., Modica, M. (2019). Industrial relatedness and regional resilience in the European Union. Papers in Regional Science, 98(2): 755-779. View

Brakman S., Garretsen H., & Marrewijk V (2019). Regional Resilience Across Europe: On Urbanization and the Initial impact of the Great Recession. Cambridge Journal of Regions Economy and Society, 8(2): 225-240. View

Giannakis, E. & Bruggeman, A. (2017). Determinants of regional resilience to economic crisis: A European perspective. European Planning Studies, 25(8): 1394-1415. View

Polese, M., Paddison, R., Hutton, T. (2015). The resilient city: On the determinants of successful urban economics. Cities and Economic Change, 16(2): 73-101. View

Chen, Y. (2024). Theoretical Mechanisms and Suggestions for Fostering the Economic Resilience of Chinese Cities from the Perspective of Urban Social Networks. China Finance and Economic Review, 13(2): 112-129. View

Bergeijk, P. A. G., Brakman, S., Marrewijk, C. (2017). Heterogeneous economic resilience and the Great Recession’s world trade collapse. Papers in Regional Science, 96(1): 3-12. View

Rocchetta, S. & Mina, A. (2019). Technological coherence and the adaptive resilience of regional economics. Regional Studies, 53(10): 1421-1434. View

Holm, J. R. & Ostergaard, C. R. (2015). Regional employment growth, shocks and regional industrial resilience: A quantitative analysis of the Danish ICT sector. Regional Studies, 49(1): 95 112. View

Li, X., Hui, E. C. M., Lang, W., Zheng, S., Qin, X. (2020). Transition from factor-driven to innovation-driven urbanization in China: A study of manufacturing industry automation in Dongguan City. China Economic Review, 59, 101382. View

Tang, D., Li, J., Zhao, Z., Boamah, V., Lansana, D. D. (2023). The influence of industrial structure transformation on urban resilience based on 110 prefecture-level cities in the Yangtze River. Sustainable Cities and Society, 96, 104621. View

Zhou, Q., Zhu, M., Qiao, Y., Zhang, X., Chen, J. (2021). Achieving resilience through smart cities? Evidence from China. Habitat International, 111, 102348. View

Guo, Y., & Zhang, H. (2022). Spillovers of innovation subsidies on regional industry growth: Evidence from China. Economic Modelling, 112, 105869. View

Li, T., Huang, X., Du, D. (2024). Empirical research on the impact of international trade network of high-tech product on its global value chain. The Journal of International Trade & Economic Development, 33(6), 1040-1073. View

Li, T., & Xiang, M. (2023). Study on Planning Layout and Spatial Form of the Third-Line Construction in North Sichuan—Taking Four Cities in Northern Sichuan as Examples. Open Journal of Social Sciences, 11(1): 325-344. View

Chen, D.L. (2014). Communist Party of China and Third Front Construction. Beijing: Communist Party of China History Publishing House. (in Chinese). View

Martin, R. & Gardiner, B. (2019). The resilience of cities to economic shocks: A tale of four recessions (and the challenge of Brexit). Papers in Regional Science, 98(4): 1801-1832. View

Fan, Z.Y., Peng, F., Liu, C. (2016). Political Connections and Economic Growth: Evidence from the DMSP/OLS Satellite Data. Economic Research Journal, 51(01): 114-126. (in Chinese). View

Baum-Snow, N., Brandt, L., Henderson, J. V., Turner, M. A., Zhang, Q. (2017). Roads, railroads, and decentralization of Chinese cities. Review of Economics and Statistics, 99(3): 435 448. View

Jacobson, L. S., Lalonde, R. J., Sullivan, D. (1993). Earnings losses of displaced workers. Upjohn Working Papers and Journal Articles, 83(4): 685-709. View